February 26, 2026

We’re excited to kick off another incredible Open Enrollment season, with plan prices starting as low as $29 a month , giving Florida families the chance to lock in future postse...

February 19, 2026

Attention Parents and Guardians! We are in the process of reviewing potential English Language Arts and Career and Technical Education core instructional materials for distric...

January 31, 2026

Coming Soon: A Better Way to Stay Connected We’re excited to announce that Madison County School District is launching Rooms , a new way for families to connect directly wi...

January 28, 2026

Commissioner Anastasios Kamoutsas Visits Madison County Central School to Celebrate Literacy Week

Madison County School District was proud to welcome Commissioner Anastasi...

January 20, 2026

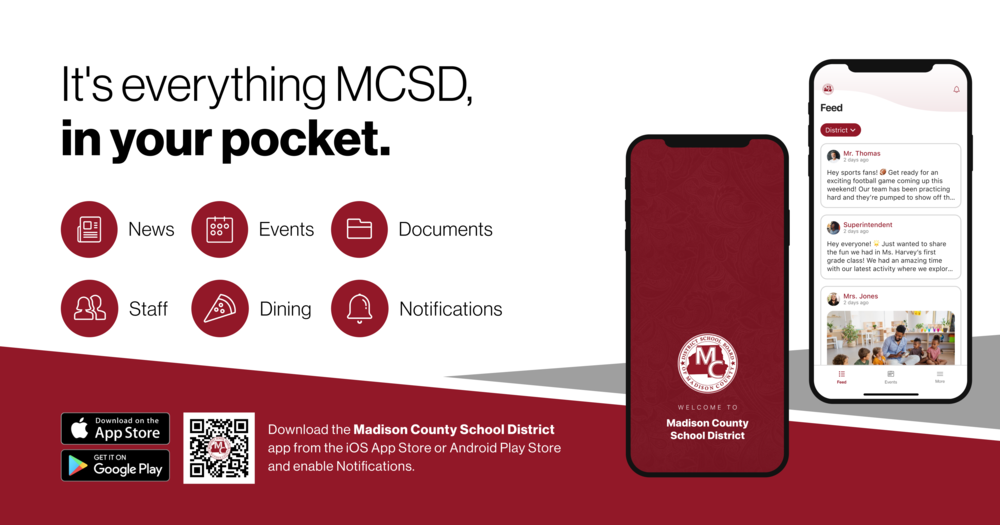

We're thrilled to announce the new app for MCSD! It's everything MCSD, in your pocket . See how it works With the new app, you can access documents, events, news updates, and...

January 16, 2026

The Madison County School District is currently experiencing a shortage of bus drivers, and we need your help! Our students depend on safe, reliable transportation to and from scho...

January 16, 2026

It's everything MCSD, in your pocket. MCSD is launching a new mobile app to help students, parents, and community members know what is happening on campus from their phones....

November 25, 2025

We are Expanding! Open Positions: Paraprofessional Speech & Language Pathologist High School ELA Teacher Elementary Teacher Child Find Parent Educator Assistant...

November 24, 2025

We want to hear from you! Click here to give your feedback.